European Pro AV Market: Where the Real Growth Is for You to 2030

Europe’s pro AV market is still growing, but it’s doing it the European way: steady, scrutinised, and increasingly tied to outcomes. The easy roll-outs already happened. The next wave is about reliability, operations, governance, and measurable value—especially as sustainability reporting and AI-enabled features creep into specs and tenders.

At the global level, AVIXA’s Industry Outlook and Trends Analysis (IOTA) forecasts pro AV revenue rising from $332 billion in 2025 to $402 billion by 2030. In Europe, AVIXA Marketing Insights has granular market size, growth, and forecasts through 2030 for 12 EU countries and regions, segmented by products/services (hardware, software, services, solutions) and by verticals/spaces.

The practical takeaway from that internal view is simple: Europe stays a large, mature revenue base through 2030, and the safest growth concentrates in specific spaces where AV is treated as infrastructure, not a nice-to-have.

This article shows where that “safer growth” tends to sit in the European market—and what it means for AV and IT pros trying to win projects and keep clients happy through 2030.

A Slower, Smarter Boom

The market isn’t stalling. It’s maturing. That changes what buyers reward.

Procurement teams now ask questions that used to arrive after commissioning. They want to know what breaks, what it costs to run, how many support tickets it generates, and what happens when the one person who “knows the system” leaves. That’s why the winners increasingly sell predictable outcomes (and the operating model behind them), not just a kit list.

This shift lines up with the IOTA story too: the industry keeps growing, but it’s growing in a world shaped by tighter budgets, higher scrutiny, and more pressure to justify spend—exactly the context AVIXA flagged in its broader IOTA commentary and reporting, such as the AVIXA IOTA coverage in AVIXA's AV News Roundup.

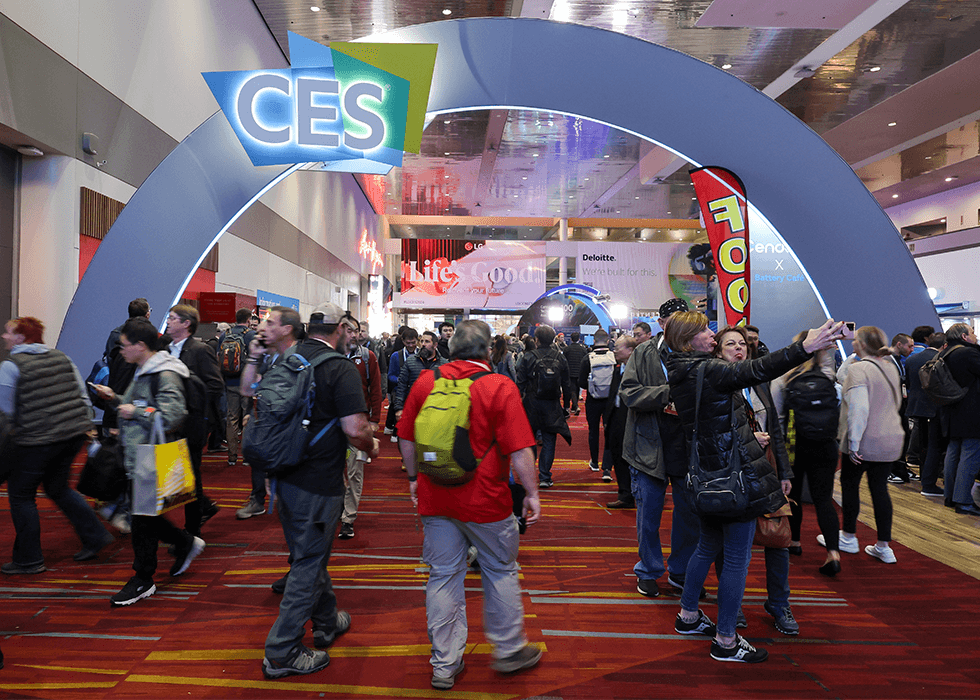

Headed to Integrated Systems Europe (ISE) this year? Check out the Megatrends programme happening

Tuesday 3 - Thursday 5 February!

Learn More

Understanding AVIXA's Taxonomy: A Broader View of the Pro AV Market

The professional AV market is vast and diverse, spanning far more than just a few key spaces. AVIXA’s taxonomy provides a comprehensive way to segment and understand the industry, dividing the market into 20 distinct spaces. The three largest—Conference Rooms, Classrooms, and Live Events/Performance and Entertainment venues—map to dominant sectors like Corporate, Education, and Media/Entertainment. However, the broader market extends far beyond these categories, encompassing areas such as live events, houses of worship, cruise ships, retail spaces, and more.

To keep this grounded in how AVIXA already structures its knowledge base for professionals, AVIXA’s topic areas and training resources also reflect those same “big buckets.” These include Conferencing and Collaboration, practical setup and workflows across Events, Meetings, Conferences, and Classrooms, and ongoing coverage in venue-focused content such as Venues, Events, and Content Production.

1. Corporate: Collaboration Spending Is Shifting From “More Rooms” to “Better Rooms”

Corporate investment is no longer about multiplying room count. It’s about making fewer, higher-value spaces work flawlessly—and keeping them working with minimal support load.

Across Europe, hybrid work has settled into recognisable patterns. Eurofound’s case-study research identifies “structured” hybrid models that typically formalise time split between remote and on-site work (often several days per week remote, with coordination managed at team level). See Eurofound’s “Inside Europe’s hybrid work strategies”.

That reality raises the baseline for conferencing AV. If the meeting experience fails, people remember. If it works, it disappears—which is exactly what buyers want.

Where the growth sits in corporate:

- Upgrades that improve outcomes (audio intelligibility, consistent camera framing, reliable control)

- Standardisation across sites (repeatable designs that reduce support burden)

- Monitoring and managed services that keep rooms stable over time

2. Education: Classrooms Are Becoming Delivery Infrastructure

Classrooms and learning environments remain one of the most durable spending areas in Europe because institutions still need to teach, train, record, and share—even when budgets tighten.

What’s changed is the expectation. Many teaching spaces now support mixed audiences: some in the room, some remote, and many watching recordings later. That pushes demand into systems that are easy for instructors to operate and easy for small teams to support consistently.

This isn’t only a technology shift. It’s an operational shift. Education buyers increasingly look for:

- repeatable classroom bundles

- consistent capture quality

- simple user control

- supportable standards and documentation

AVIXA’s own practitioner-facing learning content tracks this reality, including hands-on guidance like the AV setup guide for classrooms and events.

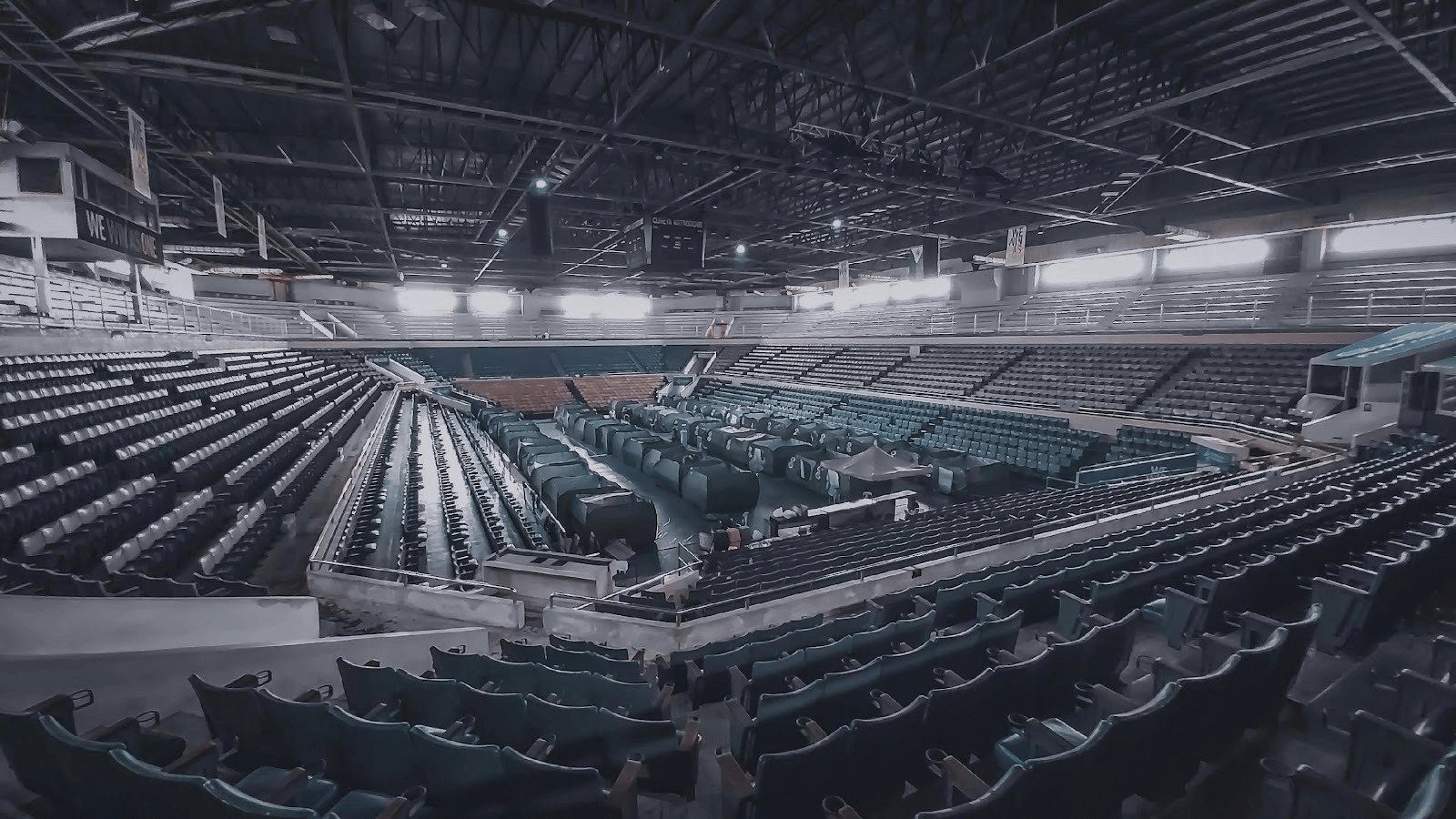

3. Live Events, Performance, and Entertainment: Experience Is the Product

Live events and performance venues don’t just “use AV.” They sell the audience experience—and that makes uptime and flexibility non-negotiable.

This segment combines permanent installs (venues, cultural institutions, houses of worship, museums) with touring and production workflows. It also increasingly overlaps with streaming, content capture, and flexible IP distribution.

If you want a simple “industry framing” reference point here, AVIXA’s own channels and topic coverage speak directly to this market’s scope. AVIXA Xchange saw a 10% increase in audience engagement with live events/performance entertainment content in 2025 over the previous year.

4. Government: Security, Defence, Control Rooms, and Infrastructure

Two growth lanes were missing from the earlier market characterisation, and they matter in Europe.

Government demand is not one monolithic block, but across Europe you’re seeing steady project flow in:

- emergency operations and command environments

- security operations centres

- briefing and situational awareness spaces

- infrastructure monitoring and public-service environments

These deployments differ from conferencing projects. They tend to prioritise uptime, resilience, secure workflows, and lifecycle support—exactly the areas where serious integrators can differentiate.

5. Broadcast AV: A new opportunity for Pro AV and Media Tech companies

The use of equipment for product-like quality by corporations and across verticals, known as Broadcast AV or enterprise broadcast is driving new opportunities for Pro AV companies and media firms.

This trend is characterized by:

- Corporate broadcast quality productions for announcements.

- Retail branding and advertising new product introductions.

- Education and public exhibition productions at historical sites, museums, schools and universities, and tourist locations.

5. Energy: Sustainability Goals Are Driving Control Rooms and Infrastructure

Energy is the second under-mentioned opportunity. Utilities and grid operators are modernising systems that must run 24/7. That drives demand for control environments, operational dashboards, and resilient infrastructure—often with long service lives and strict support expectations.

The story here overlaps with the broader EU push toward sustainability disclosure and operational accountability: buyers increasingly want systems that can be justified, documented, maintained, and measured over time.

Other Significant Growth Pockets: Healthcare, Transportation, Hospitality

Beyond the “big three,” AVIXA Marketing Insights also flags several meaningful pockets of demand:

- Healthcare: training spaces, telemedicine support environments, patient communication, and operational spaces

- Transportation: airports, rail, hubs, passenger information, and security workflows

- Hospitality: conference and event spaces, digital signage, hybrid event capability, experience-led refresh cycles

These can be regional “hot spots” even when macro growth looks modest.

The AI Question: What Will Actually Change for You?

Most buyers don’t want an AI lecture. They want to know what improves, what breaks, and what risks they inherit.

AI is already showing up inside the platforms buyers use every day. For example, Microsoft Teams continues to expand AI-backed meeting features like recap and speaker timeline views (see Recap in Microsoft Teams and Microsoft’s admin documentation on Intelligent recap). Teams also positions AI as part of improving intelligibility through features like Voice isolation. Zoom is pushing the same direction through Zoom AI Companion and related features described in its own support and release notes (for instance, Zoom AI Companion feature guidance).

For European pro AV professionals, the practical AI impact is threefold:

1. “Smarter rooms,” same floor plan

Rooms will feel more intelligent through platform features like meeting recap, transcription, and noise control. Your job is to make those features behave predictably—especially when acoustics and room design still decide whether the AI has usable inputs.

2. Operations become more data-driven

Monitoring, remote diagnostics, and AI-assisted workflows strengthen managed services and support models. That turns “install once” work into lifecycle value—and European buyers generally like predictable operational value.

3. Governance becomes part of the AV conversation

In Europe, AI also means governance questions. That’s not optional. The EU’s AI regulatory framework is now a reality, and the Commission describes the AI Act as the first comprehensive EU legal framework for AI (see the European Commission overview of the AI Act and regulatory framework for AI).

A practical rule: don’t sell “AI” as magic. Sell it as operational advantage plus configuration clarity and governance awareness.

Regulation and Sustainability Are Quietly Redrawing Your Specs

Even when nobody says “CSRD” in a meeting, sustainability reporting expectations shape procurement language and lifecycle expectations. The European Commission’s overview of corporate sustainability reporting outlines how reporting requirements and standards sit inside the EU framework.

For AV, this pressure shows up in questions about:

- energy use and efficiency

- support windows and lifecycle planning

- repairability and refresh strategy

- documentation quality and operational reporting

Those questions reward integrators and vendors who can speak clearly about lifecycle cost and operational stability.

What This Means for You (Commercial Takeaways)

If you sell into Europe, the question isn’t “is the market alive?” It’s “where is the money safest?”

The safest growth tends to sit in spaces where AV is operational infrastructure:

- Conference rooms and collaboration environments

- Classrooms and training spaces

- Live events and performance venues

- Government control, security, and infrastructure environments

- Energy control rooms and infrastructure

- Healthcare, transportation, and hospitality growth pockets

That’s also where service revenue scales, because uptime matters and buyers will pay for reliability.

My Verdict

Europe rewards operators.

The next five years are not about chasing every buzzword or swapping hardware for the sake of it. They’re about designing systems that work reliably, can be governed responsibly, and can be justified under scrutiny. Corporate, education, and live events still anchor spend—but government and energy are real European growth lanes, and healthcare, transportation, and hospitality remain meaningful pockets.

If you build your offer around outcomes, uptime, lifecycle thinking, and supportability, Europe stays one of the most dependable pro AV markets you can serve through 2030—exactly the kind of market where disciplined execution beats hype.

.png?sfvrsn=1ac0fda2_1)