AVIXA’s COVID-19 Impact Survey Sheds Light on Effects to Industry

The Impact Survey is a weekly assessment of pro-AV industry trends, attitudes and perceptions in light of the novel coronavirus and COVID-19 pandemic.

The professional audiovisual industry has woken to a new reality. As rapidly as the novel coronavirus has spread across the globe, AV solution providers (integrators, designers, manufacturers, distributors, service providers, live events companies) and their customers (end users) have begun to feel the effects, according to a new, weekly survey from AVIXA Market Intelligence.

In a survey of AVIXA AV Intelligence Panel members, fielded March 17-19, 87 percent of AV providers and 83 percent of AV end users said their companies have felt a negative impact from the coronavirus pandemic. Roughly one-third of each characterized it as a “large negative impact.”

That said, indications are the industry hasn’t ground to a halt. While the vast majority of respondents reported that their companies have adjusted by reducing travel, postponing/cancelling events, reducing/eliminating in-person meetings, and boosting telework, virtually none reported closing down operations as of publishing.

Cancelled Meeting, Events

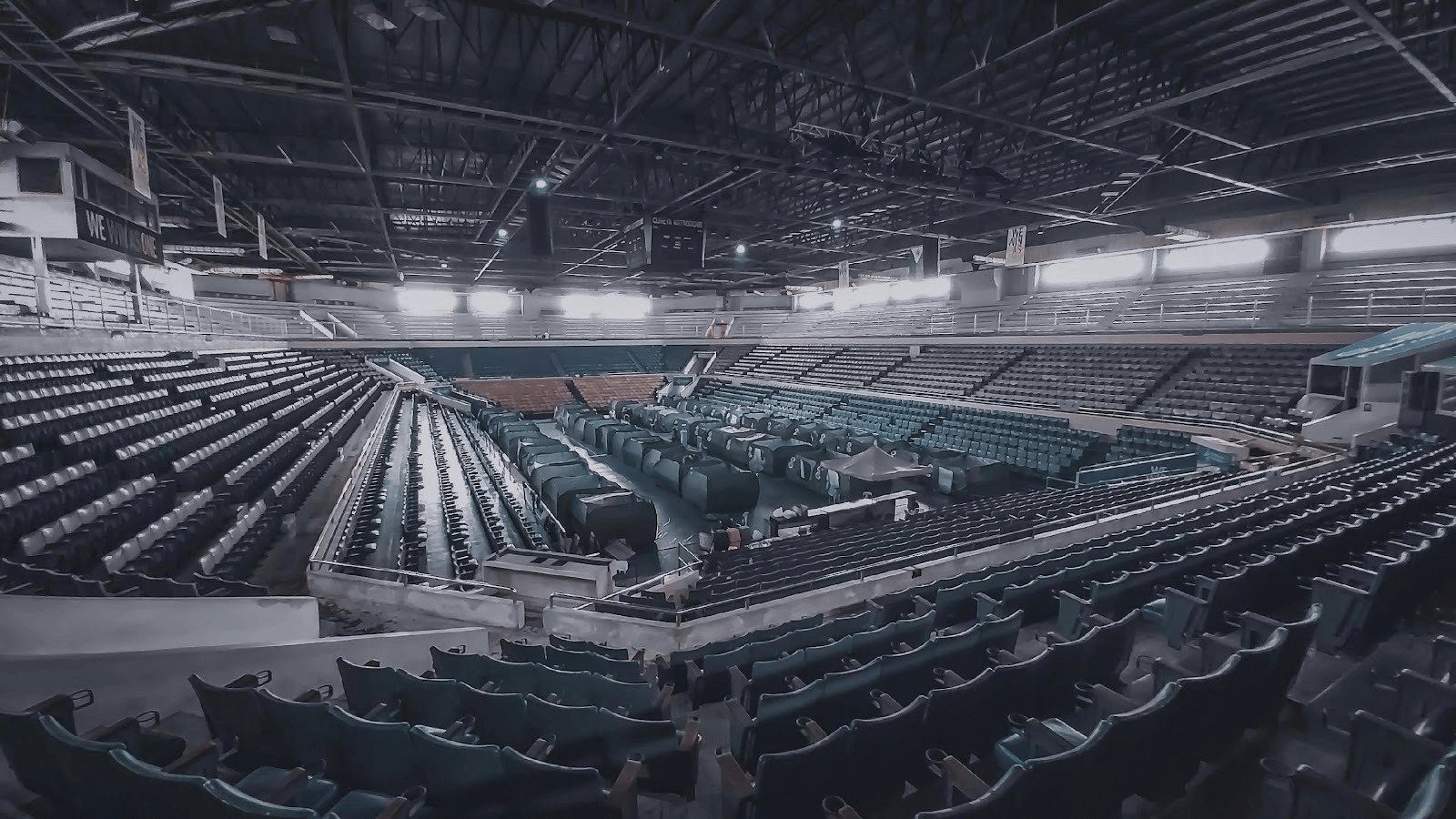

The most prevalent impact has been mass cancellation of in-person meetings, training, and other events as companies heed the direction of authorities to minimize gatherings of large, medium, or — in some cases — even smaller (as little as 10) groups of people, and to practice social distancing.

According to one AV provider: “Being mostly a live events company, we are at a standstill; all future contracts are being cancelled.” (At present, the COVID-19 Impact Survey does not explicitly break out responses from live events companies. Future surveys will.)

In addition, more than half of AV providers surveyed said they’ve experienced slowing sales, and almost half reported canceled projects. “Our hospital and health care projects have all been put on hold,” said one. “Some projects are on hold because government agencies are using spaces for the virus response,” reported another.

There are also indications that providers are feeling the impact of delayed orders (49 percent reporting a negative impact) and supply-chain disruptions (35 percent).

On the end-user side, where technology managers from higher education are well represented, cancelled projects (66 percent reporting a negative impact) and cancelled meetings/training (91 percent) are the most-cited effects of the coronavirus over the previous week. Many colleges and universities worldwide have cancelled classes and school functions, opting instead to provide teaching online.

According to one end-user respondent: “We did very little with online learning and now, a week later, we are trying to go 100-percent online. It is going much better than expected, but it’s just testing.”

Said another in higher education: “Our biggest challenge has been ensuring that we have the resources to support faculty as they prepare to teach this way.”

Perceived Impact on Revenues

Across all respondents, it is too early to assess the impact on revenues from the coronavirus pandemic. When asked to estimate revenue declines over the prior two weeks, many AV providers (29 percent) and end users (49 percent) reported that they did not know.

Still, there are indications respondents expect an impact on revenues – in some cases a significant impact. After “Don’t Know,” the most common response to the question “How much revenue reduction have you seen over the past two weeks?” was “More than 50 percent.” Over 17 percent of AV providers and 30 percent of end users estimated a drop in revenue over 50 percent.

Projects and Market Movement

Anecdotal responses to the Impact Survey begin to point toward a couple trends related to the coronavirus pandemic that may keep the AV industry moving forward in the immediate future. There are indications that some corners of the education market may generate near-term work as schools shut down, allowing for AV projects to commence or accelerate. “Some projects have moved up,” reported one AV provider, “[such as] K-12 [Primary] schools that we can get into now.”

Generally speaking, according to one end user: “Projects already scheduled are moving forward. Some projects that were on the books but not scheduled until April or May are being pushed up and installed sooner. Others may get delayed due to supply-chain issues.”

And efforts by companies to enable telework for their employees may lead to increased near-term sales of collaboration/conferencing solutions and services. “Most of our clients are making a fast move to videoconferencing and need immediate installations,” said another AV provider.

What’s Next for the Impact Survey

AVIXA’s Market Intelligence team will be looking for ways to broaden the coverage of these weekly Impact Surveys. Future surveys will include feedback specifically from companies working in live events, and more data from global AV providers and end users. We will also begin asking AV Intelligence Panel providers for information about labor and workforce trends as companies adjust to weather the current situation.

The next survey results will be released on Friday, March 27th.

If you would like to participate in the AVIXA COVID-19 Impact Survey or other AV Intelligence Panel studies, please join the free AVIXA Insight Community at avip.avixa.org.

Visit avixa.org for the latest on COVID-19 and its impact to the AV industry and to access our entire online learning catalog for free through June 12.