A New Gauge of End User Demand

A New Gauge of End User Demand

AVIXA’s New Research Reveals AV Buyers’ Purchasing Plans

By Sean Wargo, Senior Director of Market Intelligence, AVIXA

As we reflect back on the past 18 months (and even longer in many ways), one of the things that has crystalized for us over here at AVIXA is a lack of available data on the current state of demand for AV products and services. Sure, most companies get an intuitive sense for this through their own pipeline of projects and inquiries. But when pipelines break down, like they have during the pandemic, a given company doesn’t really know whether they are in a pocket of softer demand or whether there are other areas of strength to be found. Asking around among other business leaders can help provide some of this context, but there again the issue is possible near-sightedness. This becomes the most important during the inflection points since these are the moments in time when early response can be crucial to long-term success. Put another way, knowing which parts of the markets are gaining or declining at a given point in time can help business leaders plan accordingly.

During the early part of the COVID-19 lockdown, AVIXA ran weekly surveys to gauge the nearly real-time extent of the impact on AV providers, with the hope of providing both some of the broad context and showcasing areas of opportunity. This was coupled with the monthly Pro AV Business Index as a long-range pulse of the health of the channel to show the resulting inflection points in provider outcomes. And lastly, the annual Industry Outlook and Trends Analysis (IOTA) report forecasted revenues over a 5-year period based on the previous year’s results for use in benchmarking individual businesses. In each case, the issue is one of timing and sourcing. Data is captured from the provider community after the impact has been felt. It does not provide a sense for what the buyers of technology are thinking or planning in the days ahead. In simple research terms this means the studies have provided mostly a rear-view mirror perspective along with some general GPS coordinates for navigating the road ahead. They did not provide anything closer to turn-by-turn instructions or inputs. A different approach was needed to do so.

Starting in the beginning of 2021, AVIXA turned its research lens to solving this gap through the launch of a quarterly survey of end user demand under the Market Opportunity Analysis Report (MOAR) branded series of market studies. The objective is to find out what buyers of AV products and services across a core of vertical markets were planning to do in the upcoming quarter in terms of capital expenditures and technology purchases. The idea was that these plans could then trickle down into RFPs or actual purchases from the pro AV channel. Increases or declines in plans would thus alert providers of a possible change in demand for their own offerings. Or the data could point to a shift in demand towards specific markets or certain solution types. Data on staffing and procurement would highlight whether end user companies are attempting to solve their needs through insourcing or alternative channels. And attitudinal measures help show preferences in the buyers’ approach to acquisition and usage. All of this then better arming the channel with potential GPS upgrade of sorts.

So far, AVIXA has collected data for three straight quarters, representing a demand model for Q2 through Q4 of this year. The resulting samples come from six different countries, including Brazil, India, the UK, China, Germany, and the U.S., capturing a more global gauge of demand than past efforts. The study also captured sufficient input to allow for eight different vertical markets to be profiled (corporate, hospitality, healthcare, retail, education, government/energy, transportation, and venues/ entertainment).

So, what does the data say? As we would expect from the current recovery period, planned spending is on the rise in scale and scope with the allocation to AV staying fairly steady. Breaking this down, the percentage of firms saying they plan to do capital improvements has risen to 80% for the 4th quarter. Along with that, 58% also say the budget represents an increase from last year at the same time. The percentage of that budget going to AV is holding around a median of 30% as well. The profile of this spending points to an emphasis on AV production rooms for broadcast and streaming, in alignment with the rising need companies face of reaching their remote audiences. And while the rising tide lifts all boats, audio equipment was the product listed as the one with the highest percentage of planned increases in spending.

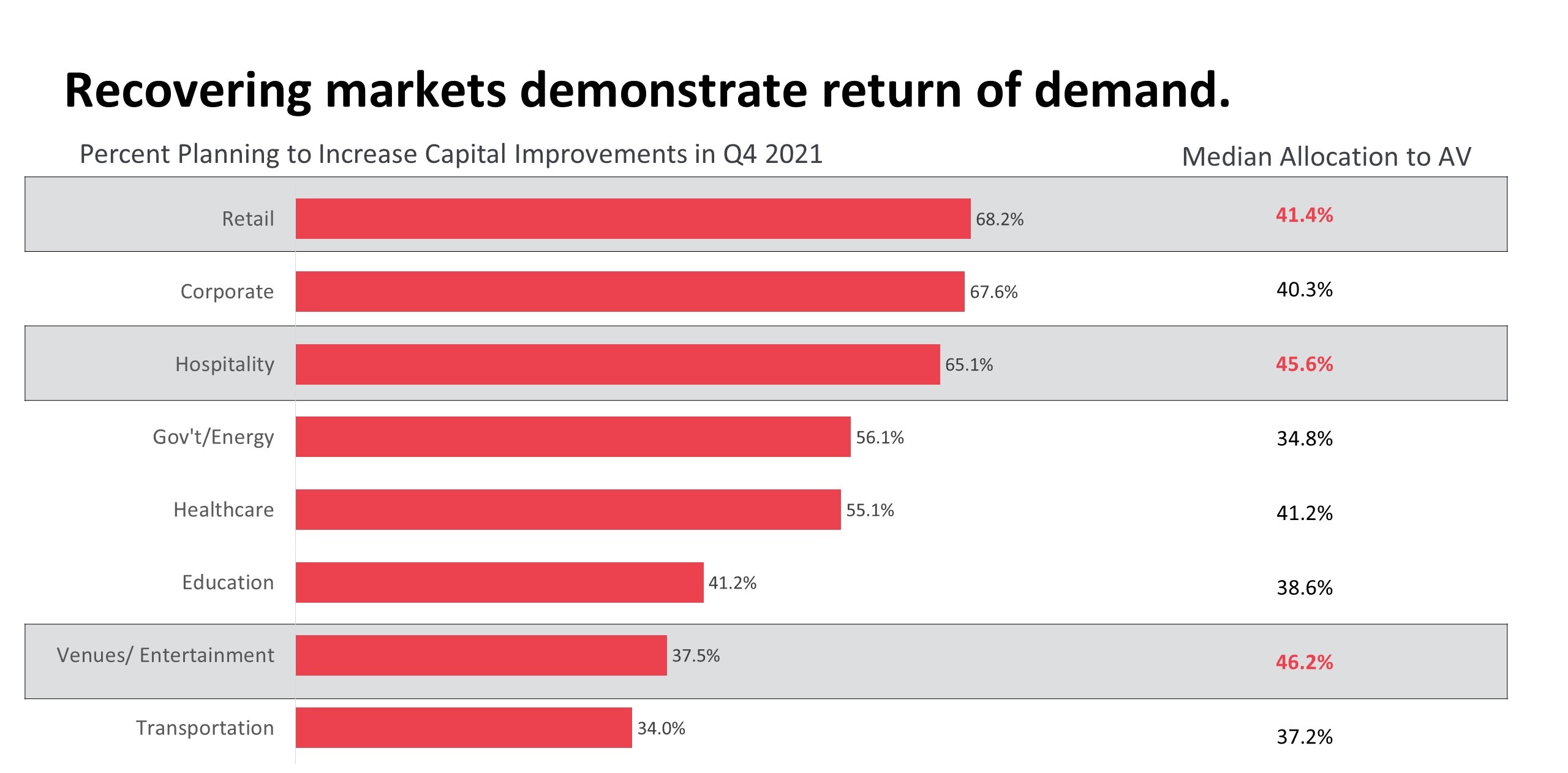

Which markets are growing the fastest? Retail, corporate, and hospitality all index higher in their intent to increase spending over the next quarter. With consumers returning to stores and resuming travel across many parts of the world, this data aligns with expectations of a corresponding recovery in expected spending. Corporate as well continues to evolve as it supports hybrid work models through an emphasis on collaboration technologies.

Ultimately, this is just the beginning of what a demand study like this can reveal. Segmenting down to a country to see how the demand differs there, analyzing the staffing level changes within markets, and tendencies towards direct purchasing of technology are also possible.

We wish you the very best as we move through recovery and into true growth as an industry!

Interested in learning more about market insights for global AV business goals? Fill out the form for a one-on-one consultation to see the AVIXA’s Global Partner Program is right for you.