AVIXA AV Industry COVID-19 Impact Survey for April 24, 2020

For Pro AV, Sentiment Plateaus as an Industry Pauses to Survey the Situation

The Impact Survey is a weekly assessment of pro AV industry trends, attitudes and perceptions in light of the novel coronavirus and COVID-19 pandemic.

Top Takeaways

- Overall, survey respondents feel the same this week as they did the week before.

- New, limited data indicates some companies have seen work returning.

- Several cite loan assistance for helping their companies weather the storm.

- Some are looking ahead and thinking about what might be different when the industry begins to see its way past the pandemic.

Generally speaking, for the first time since AVIXA™ Market Intelligence began fielding the COVID-19 Impact Survey, perceptions of the pandemic’s effect have gotten no worse. They haven’t improved significantly, either. If anything, sentiment appears to have plateaued — at least for the week.

Said one AV provider in the survey fielded April 21–22, “We seem to be somewhere in the acceptance phase of grief, fully aware that we have very little true control over when the switch is turned back on. We have shifted some of our focus to engaging our employees most affected by the realities of the industry, while also looking into options to retool the company in light of what the industry will become upon restart.”

This week, the percentage of AV end users and AV providers indicating that the pandemic has negatively impacted their company’s business held steady at 67% and 79%, respectively.

It’s worth noting, based on the impact figures just mentioned, that a significant share of respondents says — and has said since the survey began — that they have seen no impact from the pandemic. (The survey allows respondents to say they have been positively impacted, and although some respondents say so, their numbers are miniscule.)

In this latest survey, 31% of end users and 19% of AV providers said their companies had not been impacted by COVID-19. For the first time, we’ve asked these respondents to describe any positive developments at their companies. About 15% of end users cited the resumption of projects, the largest share attributed to a specific positive impact (77% did not/could not cite a specific positive impact). On the AV provider side, 30% said their companies had seen a resumption of projects; 23% cited an increase in incoming inquiries; and 14% said their companies had secured financing.

“For design consulting, things are still business as usual,” said one AV provider. “New project proposals are still going out the door. No existing projects have been put on hold. Clients are paying on time. We're patiently waiting for the other shoe to drop.”

Still, the vast majority of Impact Survey respondents face challenges, albeit no worse than in previous weeks.

Challenges Persist

The percentage of AV providers citing specific negative impacts seems to be leveling off. Among AV providers: 71% cited revenue declines, 69% slowing sales, 45% supply chain disruption, and 31% staff reductions. These figures are on par with last week’s survey.

Digging a little deeper, it’s apparent some AV companies are teetering on the edge. In previous surveys, respondents were asked to estimate the percentage declines in company revenues and staff layoffs/furloughs. At the high end, they could choose “more than 50%.” For this week’s survey, we offered more granular choices for both questions above 50%. Notably, 15% of AV provider respondents of those with revenue declines reported a drop of 91 to 100%; 14% of those with staffing reductions said their companies had laid off/furloughed 91 to 100% of their employees.

Turning to end users, there was an uptick in respondents perceiving declining revenues (60%, up from 51%) and slowing sales (29%, up from 22%). This bears watching because the business health of end user customers could have a trickle-down effect on the business prospects of their AV providers. On the bright side, the share of end users citing staff reductions over the past week was down to 19% (from 24%).

“We have not had changes in the last week — still continuing as we have been,” said one AV end user. “The only real change is that we are getting a little more efficient and productive in our transition to working remotely.”

Some Benefit From a Firmer Footing

All told, after a month of rapid deterioration in industry business sentiment, this week’s Impact Survey implies an uneasy calm. As of this writing, news coverage is highlighting efforts by some governments to reopen their economies, and in the United States, Congress appears ready to pass a bill providing additional emergency funding to small businesses.

For some in the U.S., the Economic Injury Disaster Loan (EIDL) and Paycheck Protection Program (PPP), two programs funded by the CARES Act, provided the temporary infusion they needed. In this latest survey, 57% of AV provider respondents said their companies had applied for government assistance.

“Cash reserves and EIDL/PPP loans are allowing us to operate somewhat as usual for 4 to 5 months,” said one AV provider.

According to another, “We secured additional PPP funding and are retaining all of our staff. The field techs are doing training and certification, and the rest of us are working from home on exec-level things. We are somewhat optimistic overall.”

Of course, since the last Impact Survey, the U.S. PPP ran out of funds, spurring Congress to act again. Not all companies — AV and other — received the loans they needed the first time around. About 1.6 million loans were reportedly made in round one of the PPP.

“The PPP has run out of money,” said an AV provider. “As of Friday, there were still over 2,000 applications ahead of ours at the bank. We're working on a plan to continue business with the anticipation that we won't be receiving stimulus money.”

The new pandemic-response funding bill, expected to be passed this week, includes $310 billion for additional PPP loans to small businesses.

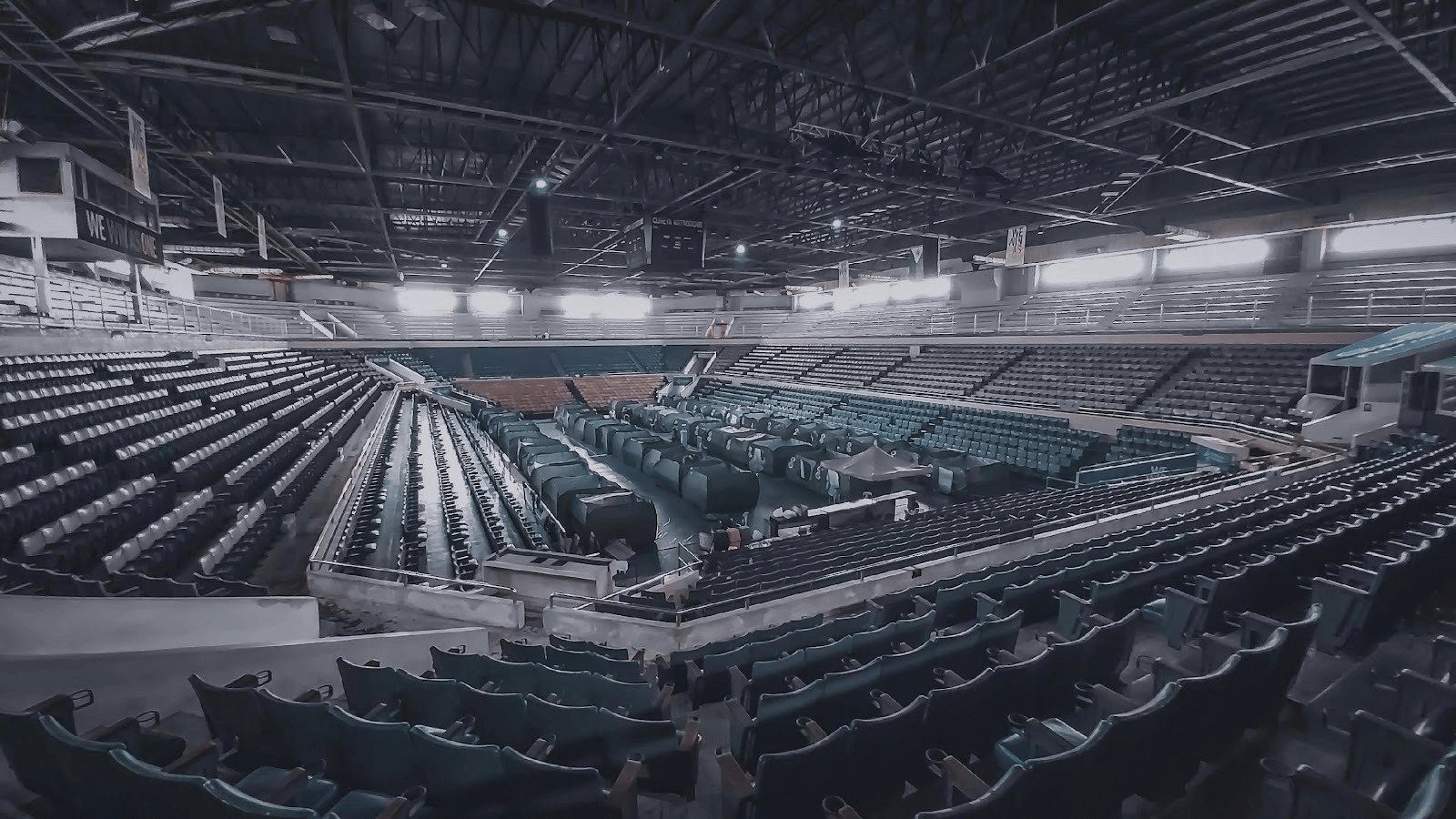

Live Events Bruised but Resolute

Even the limited sample of live events professionals in the Impact Survey are showing signs the catastrophe may be leveling off, although for many, what comes next is unclear. The live events community has been hit especially hard by cancelled events and government regulations against large gatherings. Notably, 71% of the limited live events sample said their businesses had experienced a large negative impact from the COVID-19 pandemic and 100% said their companies had been hit with declining revenue (93% have dealt with cancelled projects).

“We do parties and corporate events, with sound equipment, lights, LED screens, stages and structures,” said one AV provider. “We consider that we will have to change the business and adapt the company to carry out fixed installations at home or business, videoconferences, among other things.”

Said another, “Meetings are picking up, but not to the level they were before COVID-19.”

Coalescing Around June as the Turning Point?

When asked when they expect project work to pick up, Impact Survey respondents are eyeing anywhere in the June to September timeframe, though the share of people mentioning June was up over last week’s survey. More than 32% of AV providers and 29% of end users cited June as the month they expected project work to resume, the most popular answer.

That said, 43% of AV providers and 42% of end users expect work to start turning around in Q3. Whatever the case, some say they’re taking the time to consider how their business might change in the months and years ahead.

Said one live events respondent, “I don't necessarily think things are on an upward trajectory just yet, but we have been making a lot of progress in the research and planning stages of several major events coming up that will allow us to manage the events virtually and from a distance with health and safety concerns in mind. This is certainly a step in the right direction, as the current state of things extends into the foreseeable future, especially in live events.”

“We are experiencing a lot of requests for live streaming, apart from collaboration needs — live events being webcast and archived for later viewing,” said an AV provider. “[We’re] getting lots or requests for that and people are opening their purses to purchase the gear. I believe this may be a longer-term solution, as people have learned how to work from home, more or less effectively.”

The next survey results will be released on May 1.

If you would like to participate in the AVIXA AV Industry COVID-19 Impact Survey or other AV Intelligence Panel studies, please join the AVIXA Insight Community at avip.avixa.org.

Visit avixa.org for the latest on COVID-19 and its impact to the AV industry and to access our entire online learning catalog for free through June 12.